What do the transaction codes mean on account transcripts?

Transcripts irss verification#

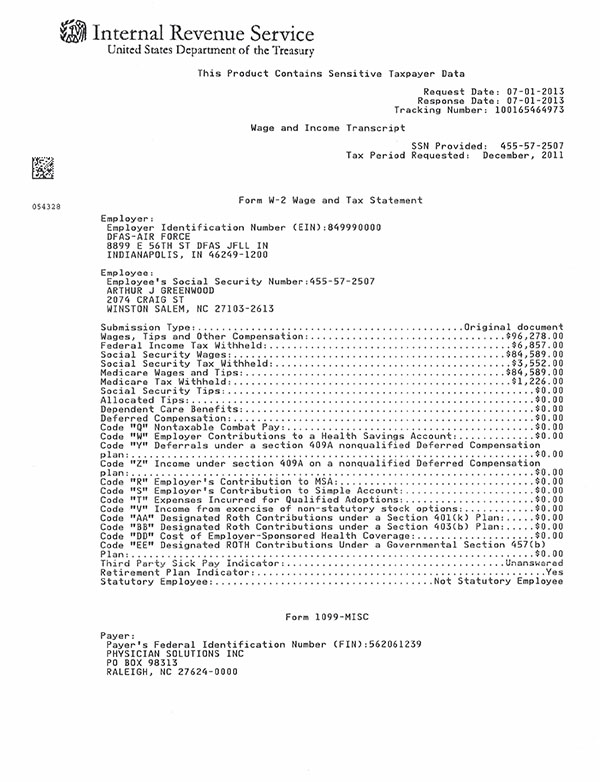

A verification of nonfiling letter is a transcript that is automatically produced when the IRS doesn’t have your return on file or hasn’t processed your filed return yet. You can use this transcript to help file an extended tax return, verify employment, or keep a personal record of income. A wage and income transcript provides a listing of information statements (Forms W-2, 1099) that show income reported to the IRS under your Social Security Number. The IRS makes this available because it shows the big picture, from your original return filed to any changes made to the return after processing. A record of account transcript is simply a combination of the account and return transcripts. If you need a copy of your tax return for any reason, such as a loan or financial aid application, this is the transcript to use. A return transcript shows most lines from your original tax return as the IRS processed it.Ĭhanges made to the return after it was processed are not reflected, including any amended returns you may have filed. Basically, if there have been any IRS actions on your account, they will appear on this transcript. An account transcript provides an overview of your account.Īccount transcripts show filings, extensions, withholding, credits and any follow-up transactions on your account, including penalties, assessments, IRS inquiries and other account activity. There are five types of IRS transcripts, which you can access online or request by phone or mail: 1. It doesn’t indicate whether you were required to file a return for that year.

Tax Return Transcript – shows most line items including your adjusted gross income (AGI) from your original tax return (Form 1040, 1040A or 1040EZ) as filed, along with any forms and schedules.

0 kommentar(er)

0 kommentar(er)